Your Card Management Tool

A better card experience is at your fingertip.

What is Card Management?

Card management is a powerful tool to enable you to manage your Grand Bank debit cards anytime, anywhere. It is located right in your mobile app, at your fingertip, and available 24/7.

You’re able to:

- turn your card on or off

- set transaction limits

- view spending habit

- receive transaction alerts to fight fraud

- report a lost/stolen card

- and much more.

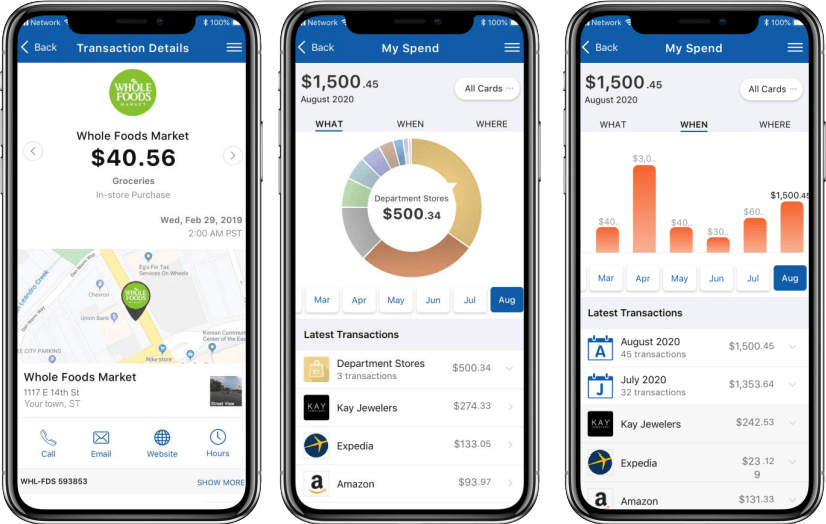

A clearer picture

Through Card Management, you will gain full control over your debit card transactions, by seeing and controlling how, when, and where your transactions occur.

Easily see a map of the locations of where your money was spent, compare spending month-to-month, and quickly see what you’re spending your money on.

Click to discover more

Card Controls

Report a Lost/Stolen Card

Test test test

Helps with Budgeting

Card Usage Alerts

Control Transaction Types

Create Travel Plans

Frequently Asked Questions

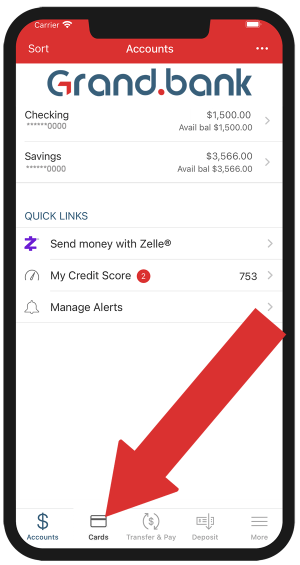

Simply log in to our Grand Bank app and tap “Cards” at the bottom of the screen to get started.

No, only our institution’s credit/debit cards are supported.

Yes, multiple cards from our institution can be accessed via one Mobile Banking account.

No, the card will be automatically updated within our Mobile Banking app.

Verify in your App Store that you have the most current version of our app installed. If an update is needed, you will see “Update” in the App Store.

Via our Mobile app, you can:

1) Lock or unlock your card if you suspect fraud or misplace your card.

2) Monitor your spending to stay within your budget.

3) Report lost/or stolen cards 24/7.

4)Even limit transactions by location, merchant, and transaction type to control how your card is used.

5) Set up alerts to stay informed.

Previously authorized recurring payments will not be affected by the card controls.

Alerts are sent as push notifications on your device. The alerts will also appear under “Messages” in the app.

Yes, an alert will be sent for all international transactions, whether they are allowed or denied.

*Grand Bank does not charge a fee for our Mobile Banking App or Online Banking, however, third-party fees for internet, messaging, or data plans may apply. Contact your wireless service or internet provider for more details. Additional terms and conditions may apply.

For additional information, please call us at (800) 300-1467.